FDI (Foreign Direct Investment) generally occurs between open economies, and it is an investment made by a firm/or individual in another country’s business/or sector. The IMF defines FDI as “cross border investment where a resident in one economy has control or a significant degree of influence in the management of an enterprise resident in another country” (Xu 2013). Generally, economists’ relationship between FDI and economic growth has been a positive one if given certain political conditions.

As long as the country that receives the investments is endowed with well-functioning institutions, protect their national properties – for instance, through fair regulations – and invest the money in human and physical capital in an adequate manner FDI can be a source of long-term economic growth (Pereira and Neves 2011). Brazil and China are two important economies when looking at inflows and outflows of FDI for development due to their recent escalation (Xu 2013). Foreign Direct Investment was severely prohibited in China before 1979 when they gradually start opening for the international market quickly China became the largest recipient of FDI. Whereas in Brazil, FDI started in the early stages after the independence, especially from Western economies, especially Britain (Xu 2013).

These two countries stimulated FDI inflows in two different manners; Brazil attracted FDI through privatization processes during the 70s and lowered regulations. China granted exemptions of taxes and facilitated a gradual entry of foreign investments. The disparity occurred on the distribution of the FDI; Brazil used its FDI to maximize public policies (such as social programs), which were benefiting the society temporarily, the logic: as long as foreign investment enters the country, public policies can continue (Xu 2012). By contrast, China focused its foreign investments inflow in Specific Economic Zones (SEZs), which embodied specific tariffs to attract more capital and technology (Xu 2012).

Moreover, at the beginning of this century, the speed of the Chinese economic growth potentialized their FDI outflows to Brazil on a large scale. Nevertheless, due to the asymmetrical partnership between China and Brazil, the positive trends/ or FDI’s outcomes are gradually disappearing for the South American country. The Chinese government’s incentives for investments in Brazil are mainly concentrated in natural resources- such as mining, extractive and agricultural activities- and are again reinforcing Brazil’s faith in its chronic dependency on commodities (Whalley and Medianu 2012). According to an OECD report released in 1998, there is a clear correlation between Environment and FDI that can offer risks or opportunities, depending on the redistribution of the FDI in the country (Ray 2016). Economists look at FDI invested in the primary sector as a source for new technologies and improvement in structural efficiencies that generates ‘sustainable environmental improvements’.

Nevertheless, to attract FDI, countries abundant in natural resources tend to lower their environmental standards and find themselves in an ‘imperative extractive problem,’ meanwhile consuming polluting goods. This is the case in Brazil. The intensification of FDI from China is of an unprecedented degree. According to the World Bank Data, only in 2009, China’s outward FDI to Brazil jumped at an unprecedented speed: US$116millions (2009), when only one year before (2008) was approximately $40 million (Whalley and Medianu,2012).

According to economic indicators, the increase of FDI inflows in Brazil goes along with the relaxing of environmental regulations. Indeed, the Amazon deforestation rates are significantly associated with the increase of Chinese enterprises financing infrastructure development projects such as roads, railways and agribusiness development (Ray 2016, 229). For instance, Mato Grosso is a federal state in the centre of Brazil and covers part of the south-Amazon region; it is one of the most important regions globally for its agricultural areas and the main producer of soybeans. Recently, Chinese investments have been mainly concentrated in Mato Grosso (Ray 2016, 230). The Chinese demand for soybeans has enhanced and accelerated the production, also causing a dramatic increase in the region’s deforestation (Ray 2016).

Additionally, to the environmental consequences, the revenues earned from the trade of this commodity have been strengthening the Brazilian agribusiness interests in the region. This had profound impacts on domestic politics, which reflected law changes that implied the weakening and relaxing of the environmental regulations. This model of development is a short-term one and is not sustainable since natural resources are finite.

In the current globalizing world, where uncertainty rises, and western hegemony seems to decline, it is essential to understand developmental alternatives without disregarding historical specificities and structural economic problems. The idea of ‘development’ has forced countries to emerge and others to suffer and eventually perish. The analysis of developmental theories applied in different regions shows the failures and successes in the last twenty years. Since the 1970s, the world has witnessed the economic growth of the West, the separation, gradual opening and economic boom of the East and the stagnation of the South. Academic debates on the paths of development have been ongoing since the Second World War, and different schools of thought have disagreed on the most fundamental basis of their theories: the definition of development. As shown by Cardoso and Faletto, there is never going to be an agreed definition of neither ‘development nor of ‘developing country.’ Countries have their historical specificities and structural impediments that are different from each other, and consequently, it is almost impossible to find a standard model for the whole world.

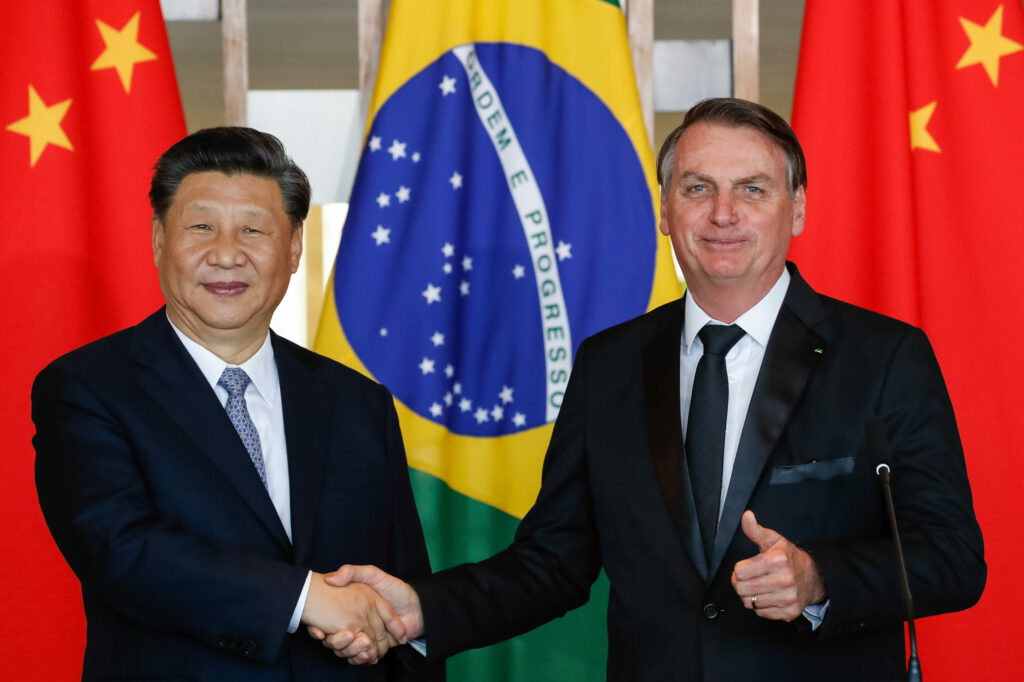

Nevertheless, the academic debate is still relevant because emerging power -BRICs- is coming with alternative paths to develop some of them being more successful. Whereas Brazil pursued a “dependent development”, China went for a neo-statist model, which has been incredibly successful. The relationship between the two BRICs countries: China and Brazil, has been deepening since 2001 and has become a central concern for the long-term development of the South American country. China has framed the relationship as a mutually beneficial and complementary one. Nevertheless, lately due to Brazilian historical specificities and its chronic dependency on commodity exports, some economists are concerned with the nature of the Chinese Brazilian partnership.

The paper defends the idea that this asymmetrical economic relationship is not sustainable in the long run. It has already been an obstacle for the development of the South American country in the past. The Brazilian economy has always been subject to another country’s economic path and success; the so-known ‘colonial relation’ continues to be perpetuated before the West, now the East (China) determines the economic growth of Brazil. By looking at the intensification of Chinese investments in the Brazilian primary sector, the analysis shows stagnation in the expansion of the industry sectors in Brazil.

Additionally, the relaxed environmental Brazilian regulation combined with the intensification of Chinese FDI has been sourcing long-term consequences for the environment (Amazon region). The question is: How can this relation be sustainable if it is based on finite natural resources that are being extensively damaged and exploited? China-Brazil’s economic relation is not a win-win relationship; it is asymmetrical, creating severe consequences for the Brazilian largest share of GDP: commodities.

Ti potrebbe interessare anche: Assessora della Lega: “Mio figlio con lo smalto? Lo caccerei di casa”. E Fedez la zittisce